Column

When considering the purchase of real estate using crypto assets, many people ultimately stop at What about taxes?" This is the point.

In this article,Basic tax considerations when crypto assets are pledged as collateraland points to keep in mind when purchasing real estate.

First of all, many people are concerned about this,Simply pledging crypto assets as collateral is not, in principle, taxable.

The reason is simple,

This is due to the following reasons.

Collateral provision is onlyEstablish terms and conditions for fundingand income is not determined at this point.

On the other hand, taxation may occur in the following cases

This is the most straightforward: any gain on the sale is, in principle, taxable.

If the collateral value falls below a certain level and the crypto asset is forcibly sold or liquidated, the result may be treated as a "sale" as well.

The treatment of interest and compensation associated with crypto asset-backed loans also needs to be sorted out for tax purposes, depending on the terms of the agreement.

Even when purchasing real estate with funds raised against crypto assets,Taxation on the real estate side is the same as in a normal real estate transaction.It is.

Specifically,

and so on.

There is no such thing as "special taxes because of the use of crypto assets," though,State that can explain the source of fundsIt is important that the

When using crypto assets as collateral, special attention should be paid to the following points

Taxation is not just about "results",Transaction realityIt is very important to organize in advance because the decision will be made based on the

In many cases, the conclusion of the treatment of crypto assets and taxation depends on individual circumstances.

Therefore,

must be separated.

For final tax decisions,Always check with a tax accountant or other professional.The first two are the following.

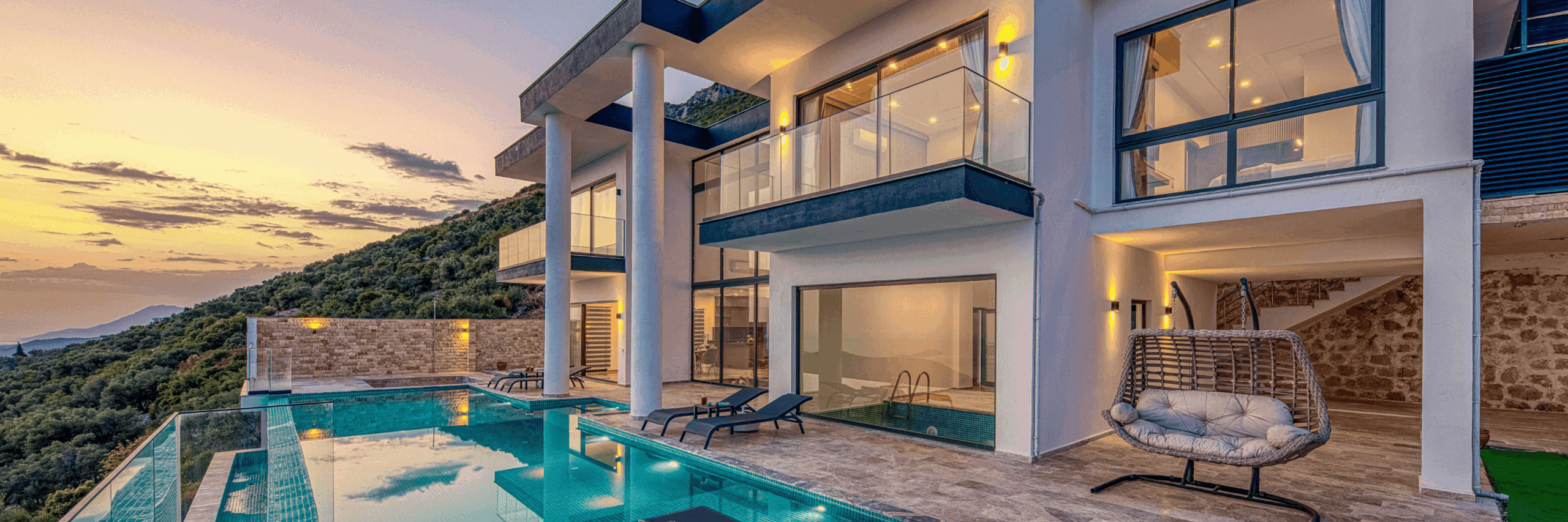

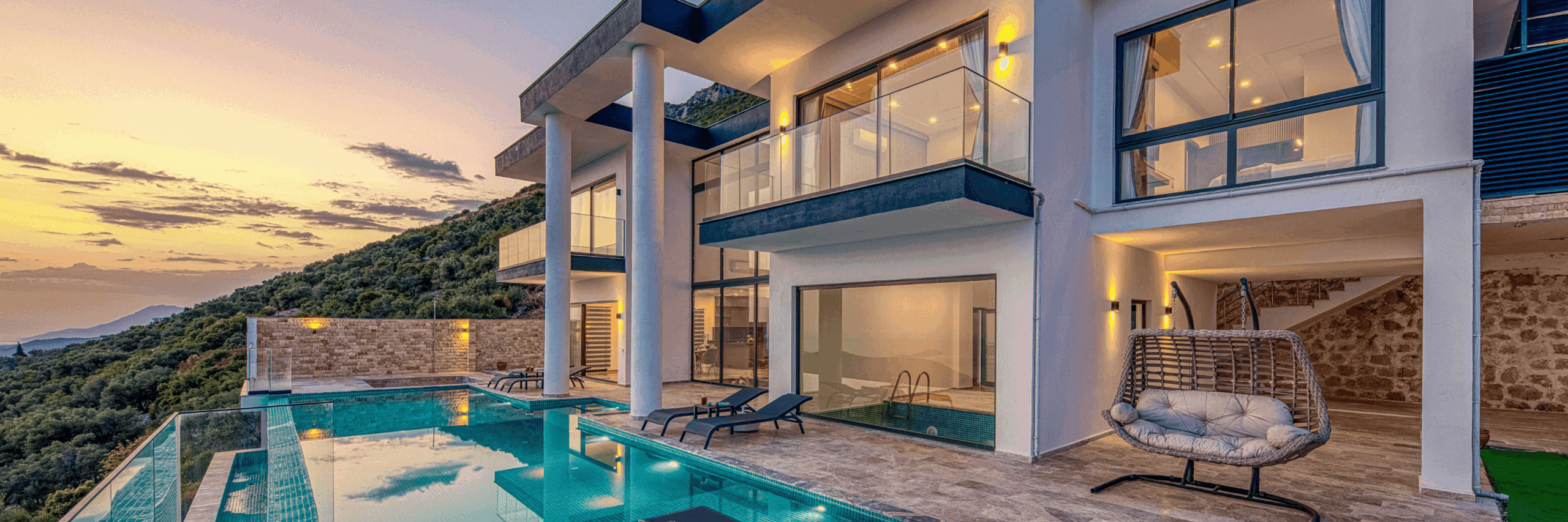

The purchase of real estate using crypto assets is,A realistic option if you understand how it works and design it carefullyIt is.

CryptoHome focuses on organizing information and providing decision-making resources so that you do not get lost in the final stages of these considerations.

If you are interested in real estate investment in Japan utilizing cryptocurrency, please contact us here.

CryptoHome

〒285-0927

1675 Shisui, Shisui Town, Inba District, Chiba Prefecture